Investment Funds

How to Set-up your Investment Fund in Cyprus:

Obtainment of Applicable Licenses

Advice on Tailored-Made Fund Structures

Guidance and On-going Administration

Compliance and Supervision of Business Transactions

Introduction:

- Cyprus synergizes its existing Tax-Efficient regime with top-notch service providers at a competitive price point, maintaining high service quality, to establish and nurture thriving European and International Investment Funds Hub for management and administration.

- As an early adopter of the Alternative Investment Fund Managers Directive within the EU, Cyprus boasts a versatile legislative framework catering to various types of Investment Funds.

- A standout advantage of Cyprus is its holistic suite of Investment Funds Services, covering everything from licensing to ongoing administration, setting it apart from other jurisdictions.

- Additionally, seamless coordination between regulatory bodies and service providers ensures prompt and efficient service delivery to clients.

- Our firm is dedicated to delivering bespoke solutions of the utmost caliber to each client, addressing all aspects of Investment Funds operations, including registering Fund Managers and offering comprehensive advice on matters pertaining to Investment Funds domiciled in Cyprus and beyond.

What is an Investment Fund:

- Investment Funds, also referred to as collective investment schemes or mutual funds, serve as registered or domiciled vehicles in the Republic of Cyprus, providing eligible investors with significant advantages in terms of tax neutrality, speed, and flexibility.

- In essence, Investment Funds serve as vehicles to pool investments across various sectors, encompassing private equity funds, venture capital funds, distressed opportunities funds, real estate funds, funds of funds, and hedge funds, among others.

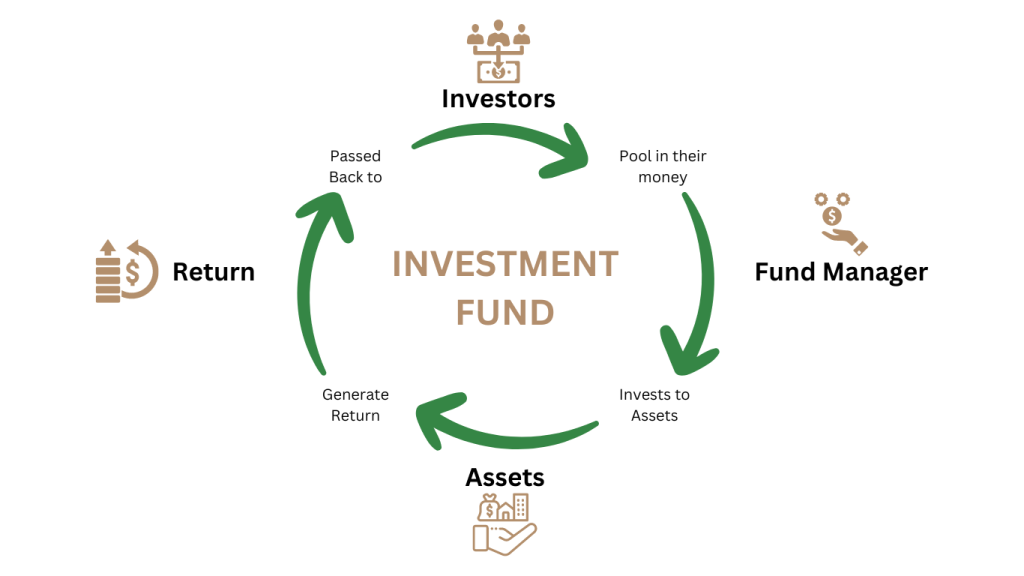

- An Investment Fund is essentially a collective investment endeavor that aggregates external capital from numerous investors, aiming to invest it according to a predefined investment policy for the mutual benefit of those investors.

Types of Investment Funds in Cyprus

Alternative Investment Fund (AIF)

Read More Here!

Registered Alternative Investment Fund (RAIF)

Read More Here!

The various Investment Fund Structures mentioned above can incorporate multiple investment compartments, facilitating the segregation of assets and liabilities among them.

Moreover, each compartment has the flexibility to define its individual investment policies, minimum subscription thresholds, redemption terms, and other parameters. It’s worth emphasizing that the operational expenses associated with each investment compartment are notably lower in comparison to establishing a distinct separate fund for each.

Investment Fund Legal Structures:

- Variable Capital Investment Company (“VCIC”)

- Fixed Capital Investment Company (“FCIC”)

- Limited Partnership (“LP”)

- Common Fund (“CF”) – except for the AIFLNP

Alternative Investment Fund (AIF)

- Alternative Investment Funds (AIFs) are pooled investment vehicles designed to gather capital from multiple investors.

- Their primary objective is to deploy these funds according to a clearly outlined investment policy and strategy, ultimately aiming to generate returns for the investors involved.

Characteristics of AIFs

Authorisation

Granted by the Cyprus Securities and Exchange Commission ("CySEC")

Investors

AIFs can be addressed to unlimited number of investors, provided that the legal form of the AIF allows it, including the Professional investors, Well informed investors and Retail investors.

Management

AIFs can be self-managed or can appoint an external fund manager.

Listings

AIFs may be listed and traded on a regulated market.

Depositary

The appointment of a depositary is mandatory for AIFs.

Minimum Assets Under Management (AUM)

Within 12 months from the date of their registration with the CySEC, AIFs must raise capital of at least €500,000- (Five Hundred Thousand Euros) from investors. – May be extended to 24 months upon approval from CySEC.

Minimum Capital Requirements

Unless an AIF is externally managed, in the form of an investment company, an AIF must have an initial capital requirement of €125,000-(One Hundred and Twenty Five Thousand Euros).

Registered Alternative Investment Fund (RAIF)

- RAIFs offer a faster and more cost-effective means of establishing AIFs in Cyprus. Unlike traditional AIFs, RAIFs do not necessitate authorization from CySEC to begin operations, provided they are externally managed by an AIFM established in Cyprus or another EU Member State.

- Instead of undergoing a formal authorization process, RAIFs only need to be notified to CySEC and listed in a dedicated RAIF Register maintained by the regulatory body.

Characteristics of RAIFs

Authorisation

Not required, but must be registered to the RAIF Register maintained by the CySEC.

Investors

RAIFs can be addressed to an unlimited number of investors, and only to Professional and/or Well-informed Investors.

Management

Apart specific exceptions, RAIFs must always be externally managed by an Alternative Investment Fund Manager (“AIFM”).

Listings

RAIFs may be listed and traded on a regulated market.

Depositary

The appointment of a depositary is mandatory for RAIFs.

Minimum Assets Under Management (AUM)

Within 12 months from the date of their registration with the CySEC, RAIFs must raise capital of at least €500,000- (Five Hundred Thousand Euros) from investors. – May be extended to 24 months upon approval from CySEC.

Minimum Capital Requirements

RAIFs have no initial capital requirements.

Alternative Investment Fund with Limited Number of Persons (AIFLNPs)

- In general, Alternative Investment Fund Limited Number Partnerships (AIFLNPs) are subject to a less rigorous reporting framework compared to other types of Investment Funds. It’s crucial to emphasize that if an AIFLNP meets certain criteria, the requirement to appoint a depositary may be waived:

- Total AUM of all investment compartments is less than €5,000,000.

- Total number of investors for all investments compartments, do not exceed 5 (Five) persons

- Total assets which are subject to custody, do not exceed the limit of 10% (Ten Percent) of the total value of the AIFLNP’s portfolio.

Characteristics of AIFLNPs

Authorisation

It is required by the Cyprus Securities and Exchange Commission ("CySEC")

Investors

AIFLNPs may be addressed to up to 50 natural persons, and only to Professional and/or Well-informed Investors.

Management

AIFLNPs can be self-managed or can appoint an external fund manager.

Listings

AIFLNPs cannot be listed or traded on a regulated market.

Depositary

Subject to specific conditions, the appointment of a depositary is not always mandatory for AIFLNPs.

Minimum Assets Under Management (AUM)

Within 12 months from the date of its authorisation, an AIFLNP must raise capital of at least €250,000- (Two Hundred and Fifty Thousand Euros) from investors to be able to commence its operations. – May be extended to 24 months upon approval from CySEC. – The initial capital requirement cannot be taken into account.

Minimum Capital Requirements

Unless an AIFLNP is externally managed, in the form of an investment company, an AIFLNP must have an initial capital requirement of €50,000-(Fifty Thousand Euros).

Benefits of Investment Funds in Cyprus

Few or No restrictions on types of Investments

CySEC – The Regulator imposes almost no restrictions in the type of investment of an AIF in Cyprus.

Self-Managed Funds

Both AIFs and AIFLNPs have the option to be internally managed, as a result there is no requirement for appointment of a Fund Manager, leading to saving ongoing costs and efficiency.

Stock Exchange Listing

AIFs and RAIFs in Cyprus may be listed in Cyprus and/or any other Stock Exchange or listing of the fund in international information services.

No Capital Gains Tax

Investment Funds in Cyprus are exempted from the payment of any Capital Gains Tax (GGT) on disposal or redemption of fund units.

Fast Set-Up

The establishment of an AIF in Cyprus is relatively straight forward with an estimated time for obtainment of license, up to 6-8 months and specifically for a RAIF, up to 4-8 weeks.

Umbrella Funds

Investment Funds in Cyprus may be established as umbrella funds, meaning that segregated sub-funds with a variety of different investment policies, type of assets and investment strategies may be created.

No withholding Tax on Dividends

Dividends distributed to the unit holders of an Investment Fund in Cyprus, are exempted from tax or any withholding tax.

No Value Added Tax (“VAT”) on Fund Managers

Value Added Tax is completely exempted from the Management Services provided by a Fund Manager to an Investment Fund in Cyprus.

Taxation on Investment Funds in Cyprus

Tax Exemption on profits generated by the disposal of securities.

*Important to be noted that the Cyprus Tax Authorities have provided a wide definition of what constitutes eligible securities/titles.

Tax Exemption on dividend income (subject to certain conditions).

No withholding tax on repatriation of dividends, interest and royalties to non-residents.